Emerging IR LED, laser diode applications to triple market by 2022

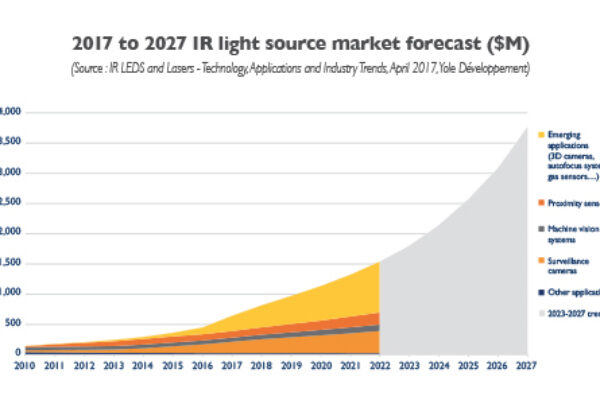

According Yole, the IR LED/LD market will triple in value over the next five years to reach $1.5B in 2022. That’s because of five applications that are now emerging, boosting the demand for IR illumination, namely 3D cameras, where they can help provide depth of focus, autofocus, surveillance cameras, machine vision and horticultural lighting.

Together these five areas will represent a market worth more than $1B in 2022, increasing from less than $400M expected in 2017.

These applications mix industrial uses such as surveillance cameras, machine vision and horticultural lighting and consumer uses related to mobile phones, including 3D cameras and autofocus and they call for different solutions.

According to Yole, 60% of the market value in 2022 will derive from LD and vertical cavity surface emitting laser (VCSEL) devices, although these products will only represent 20% of the volume for the sector, most of this being VCSELs. VCSELs are particularly suitable for integration into packages, combining with IR imagers and detectors and related optics and packaging. The first products using this integration strategy include STMicroelectronics’ time-of-flight sensor, as analyzed by System Plus Consulting in the report STMicroelectronics Time of Flight Proximity Sensor in the Apple iPhone 7 Plus.

Beyond STMicroelectronics, other companies offering such devices include ams, Sony and PMDTechnologies. A complete ecosystem is now emerging in order to deliver the expected growth.

IR LED/LD manufacturers include Osram, Lumentum, Everlight, Princeton Optronics and II-VI. Lens manufacturers include Largan, Sunny and O-Film. Module makers include Jabil, Sharp and LG Innotek. The companies have different strategies but several players are starting to be completely integrated. ams and Sony, for example, have all the technologies and devices to provide complete modules to their customers in house.

ams has made a series of acquisitions in the last 18 months enhancing its abilities by buying image sensor provider CMOSIS, 3D imaging and light management technology company Heptagon and finally Princeton Optronics. ams has now the ability to become a juggernaut in this market. Sony is another potential strong player, with everything in-house and the ability to provide advanced products for all these growing applications.

Yole expect several technical developments from IR illumination manufacturers, both at the chip and package level. IR LED manufacturers are re-using traditional techniques from the visible LED industry but still need to fine-tune them to increase device efficiency and reliability. The main issue really comes with manufacturing longer wavelength LEDs, over 1,060nm, which requires investigation of new materials and processes. LDs and VCSELs have the advantage of beam coherence and wavelength stability but still represent an emerging technology. They also face several challenges, including in efficiency, thermal management, beam shaping, manufacturing yield and cost.

The market research firm notes that although the IR illumination market is likely to boom in the next five years, the growth will not stop in 2022. In the longer term, other applications will support market expansion. Light Detection and Ranging (LIDAR), gas sensors, glucose sensors and eye tracking systems will push the market to $3.8B in 2027.

Yole Développement – www.yole.fr

If you enjoyed this article, you will like the following ones: don't miss them by subscribing to :

eeNews on Google News

If you enjoyed this article, you will like the following ones: don't miss them by subscribing to :

eeNews on Google News